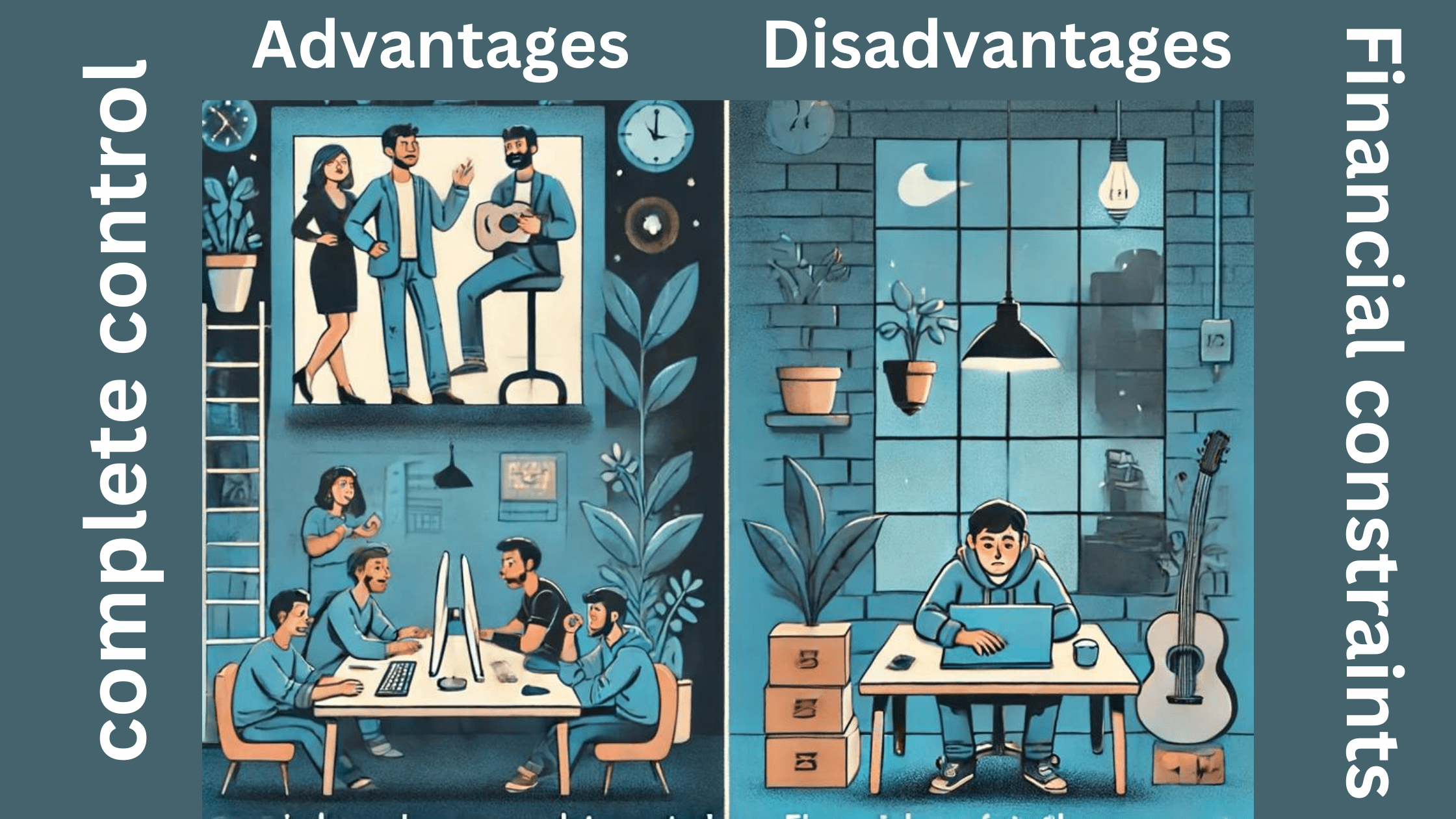

Bootstrapping, funding your startup with your own resources, has both advantages and disadvantages to consider. Here’s a breakdown of both:

Advantages of Bootstrapping

- Retained Control: Bootstrapping allows founders to maintain a significant ownership stake in their company. Without the need to relinquish equity to external investors, founders can retain control over strategic decision-making and steer the company’s direction according to their vision.

- Focus on Profitability: Bootstrapped startups, lacking access to readily available capital, are forced to prioritize profitability from an early stage. This focus on generating revenue and controlling costs fosters financial discipline and a sustainable business model.

- Resourcefulness and Innovation: Bootstrapping encourages creative problem-solving and resourcefulness. Faced with limited resources, startups need to find innovative solutions to acquire necessary materials, technology, and talent. This fosters a culture of ingenuity and adaptability.

- Customer Focus: Bootstrapped startups typically focus heavily on understanding customer needs and developing a valuable product-market fit. Since reliance on external funding is minimal, founders must prioritize customer satisfaction and build a strong brand reputation for organic growth.

- Stronger Teams: Bootstrapping often attracts individuals who are passionate about the business and willing to work for less upfront compensation. These individuals are driven by the opportunity to make a difference and build something significant from the ground up. This can create a more cohesive and focused team environment.

- Reduced Risk: By relying on internal funds, bootstrapped startups minimize the risk of financial burden associated with debt financing or the pressure to meet investor expectations for rapid growth, which can lead to overspending and unsustainable practices.

Disadvantages of Bootstrapping

- Limited Funding: Bootstrapping can restrict a startup’s ability to scale rapidly. Without access to significant capital, acquiring necessary resources for aggressive expansion may be challenging.

- Slower Growth: Organic growth, a hallmark of bootstrapping, can be slower than growth fueled by external investments. This may be a disadvantage for startups operating in highly competitive markets or those requiring rapid market penetration.

- Talent Acquisition: Bootstrapped startups may struggle to attract top talent due to potentially lower salaries and limited benefits compared to well-funded companies.

- Limited Resources: Bootstrapping means working with fewer resources for things like marketing, technology, and equipment. This can make it challenging to compete with well-funded rivals.

- Pressure and Risk: Founders may face significant financial pressure as their personal savings are often at stake. Additionally, bootstrapping can be risky because there’s less of a safety net if things go wrong.

- Limited Expertise: Bootstrapped startups might lack access to the expertise and guidance often provided by experienced investors and advisors

Choosing Bootstrapping:

Bootstrapping can be a viable option for startups with low initial costs, a focus on recurring revenue, and a patient growth plan. If your business requires significant funding or rapid scaling, seeking investment might be the better route.